Medicare Supplement Plans

Are you looking for additional coverage to complement your Original Medicare benefits? MediPlans NJ offers a range of Medicare Supplement Plans designed to provide you with peace of mind and comprehensive healthcare coverage.

Medicare Supplement Plans, also known as Medigap, help cover out-of-pocket costs such as deductibles, coinsurance, and copayments that Original Medicare doesn't fully cover. With our expertise and personalized approach, we'll help you understand your options and find the plan that best suits your needs and budget.

At MediPlans NJ, we prioritize transparency and clarity. We'll walk you through the various Medicare Supplement Plans available, explaining their benefits and costs in detail. Whether you're interested in Plan A, Plan F, Plan G, or any other option, we'll ensure you have all the information you need to make an informed decision.

When you choose MediPlans NJ for your Medicare Supplement coverage, you can rest easy knowing that you have a dedicated partner committed to your health and financial well-being. Contact us today to explore your Medicare Supplement Plan options and take the next step towards comprehensive coverage and peace of mind.

Commonly Asked Questions about Medicare Supplement/Medigap:

How much do Medicare supplements cost?

The cost of Medicare supplements, or Medigap plans, can vary depending on several factors, including:

1. Location: The cost of healthcare services can vary by region, so the price of Medigap plans may also vary depending on where you live.

2. Insurance Company: Different insurance companies offer Medigap plans at different prices. It's essential to compare plans from various insurers to find the best price for your needs.

3. Plan Type: There are several standardized Medigap plans, labeled with letters (e.g., Plan N, Plan G, etc.). The costs can vary depending on the specific benefits provided by each plan. Generally, plans with more comprehensive coverage will have higher premiums.

4. Age: Insurance companies may base their premiums on your age, with rates potentially increasing as you get older.

On average, Medicare supplement premiums can range from around $100 to $300 or more per month. It's crucial to research and compare plans carefully to find one that fits your budget and healthcare needs. Additionally, it's wise to consider any potential rate increases over time when choosing a plan.

What is the Most Comprehensive Medicare Supplement Plan?

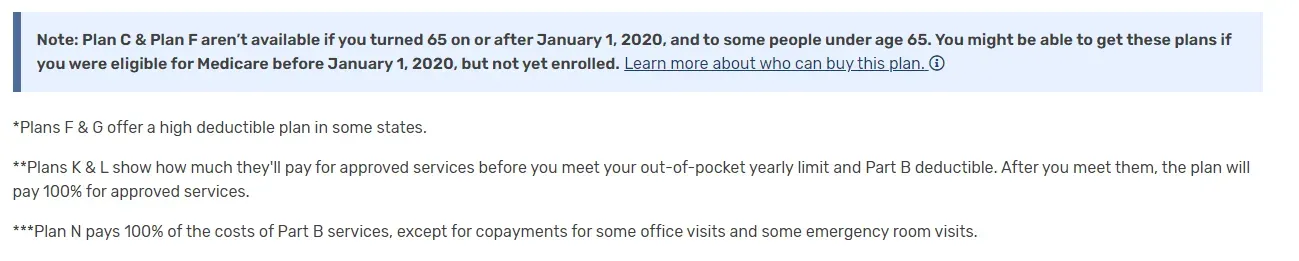

The most comprehensive Medicare supplement plan is often considered to be Plan F. However, Plan F is no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. Instead, the most comprehensive plan currently available is Plan G.

Plan G offers nearly identical coverage to Plan F, except for one difference: it does not cover the Medicare Part B deductible. Once you meet the Part B deductible for the year, Plan G covers the remaining Medicare-approved costs at 100%. This makes it an extremely comprehensive plan, providing coverage for most, if not all, out-of-pocket expenses associated with Medicare-covered services.

Other comprehensive plans include Plan C, Typically for those under 65 on disability, this is also no longer available to new Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020, and Plan D. These plans offer similar coverage to Plan G but may have different premium costs.

It's essential to carefully consider your healthcare needs and budget when choosing a Medicare supplement plan, as the most comprehensive plan may not always be the best option for everyone. Additionally, plan availability and coverage options can vary by location and insurance provider.

Compare Medicare Supplement Plans

Chart Intro