Medicare Costs for 2025

Planning for Medicare involves understanding various factors, including Deductibles, Part B Premium, IRMAA, and Plan Premiums. Considering all of the costs on this page helps you figure out what your monthly costs will be.

See below to break down each category:

Secondary Plan Premiums

Whether you choose an Advantage Plan or a Medi-Gap Plan, it's important to know how much you will be paying each month towards the Premium.

Costs will vary, with Medicare Advantage Plans typically having lower premiums than Medicare Supplement Plans.

Advantage plan premiums average between $0 and $170 per month. Costs are the same across gender and age brackets. However, costs can differ based on carrier, plans, and zip code.

Medi-Gap Plans typically have higher premiums. For Plans N, G & F, premiums average $97 to over $400 (depending on age & gender). Men have slightly higher premiums than women, and premiums increase annually, so the greater the age, the higher the premium.

Part B Premium

The "Part B premium" typically refers to the premium paid for Medicare Part B coverage. The premium amount can vary based on your income.

Medicare will deduct your Part B premium from your Social Security every month if you are collecting Social Security benefits. If not, they will send you a quarterly bill.

The base Part B Premium for 2025 is $185.

In addition to your Medicare Part B premium, you may need to pay an additional premium for your Prescription Drug Plan. This premium can vary depending on the plan you choose and your financial standing.

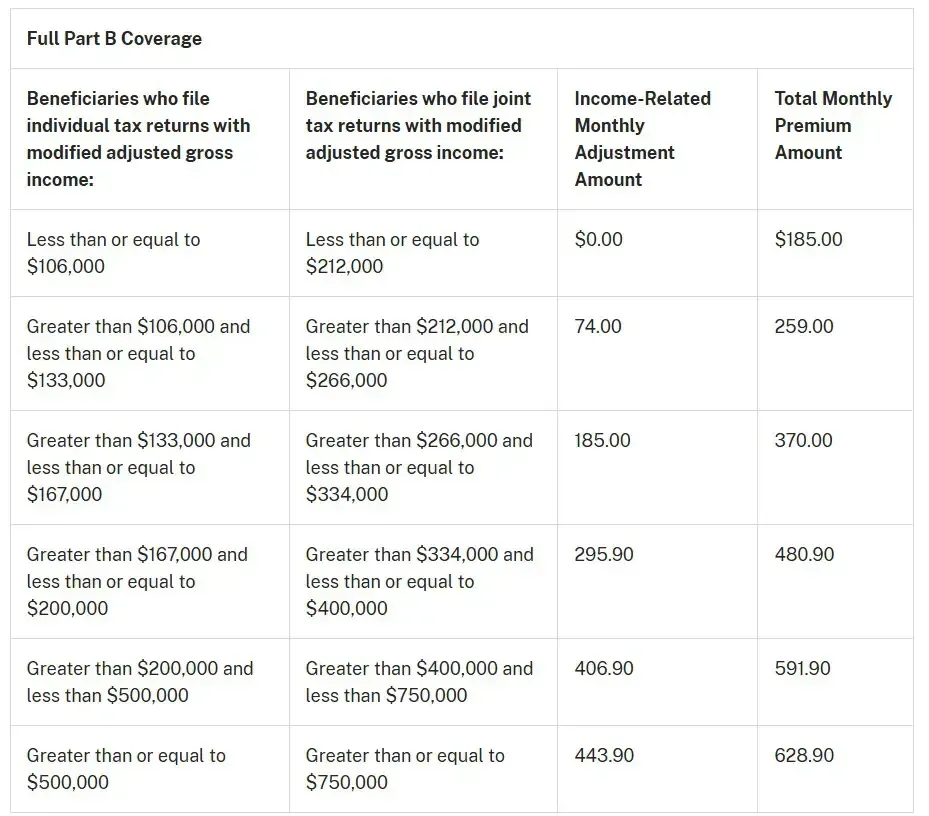

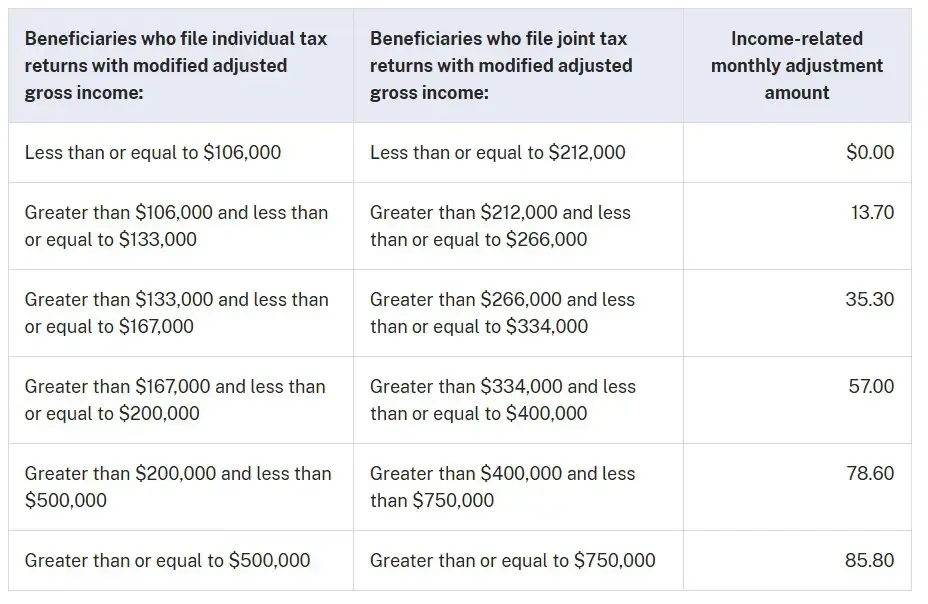

IRMAA

IRMAA stands for Income-Related Monthly Adjustment Amount. It's an additional cost that high-income Medicare beneficiaries may need to pay for their Part B & Part D premiums.

IRMAA is based on your modified adjusted gross income (MAGI) from two years prior. If your income exceeds certain thresholds, you may be subject to IRMAA, resulting in higher premiums for your Prescription Drug Plan and Part B coverage.

If your income has dropped over previous years, you may appeal the cost basis and have your premium lowered to match your current income.

Part B Deductible

The Part B deductible is a fixed amount of money you must pay out of pocket for covered medical services before Medicare begins to pay its share. Medicare Part B covers outpatient services such as doctor visits, preventive care, and durable medical equipment. After you meet the deductible, Medicare typically pays 80% of the Medicare-approved amount for covered services, while you're responsible for the remaining 20%.

The part B deductible for 2025 is:

$256 annually

Part D Premiums & Deductible

In order to utilize your Part D benefit, you must purchase a Prescription Drug Plan (PDP). PDPs typically have a monthly premium. If you are collecting social security, you can opt to have the premium deducted from your monthly benefits. If not, you can choose to be billed or have the carrier automatically debit funds from your checking account.

In addition to the premium, if you exceed the base income bracket, you may need to pay an additional premium for your Prescription Drug Plan. This premium can vary depending on the plan you choose and your financial standing.

Prescription Drug Plans also include deductibles, which are the initial amounts you must pay out of pocket before your plan starts to cover costs. Deductibles can vary between plans, so it's essential to review your plan's deductible amount and any associated details carefully.

2025 IRMAA Limits (Income-Related Monthly Adjustment Amount)